SHAH ALAM: THE full privatisation of Boustead Naval Shipyard (BNS) – it appears – has gone through with the company now renamed as Lumut Naval Shipyard (LNS). As part of the deal, the government via its MOF Incorporated Company, Ocean Sunshine Berhad (OSB) – will inject some RM190 million as working capital for LNS via a share-issuance exercise.

Boustead Heavy Industry Corporation Bhd made an announcement to Bursa Malaysia today:

BOUSTEAD HEAVY INDUSTRIES CORPORATION BERHAD (“BHIC” OR THE “COMPANY”)

PROPOSED ISSUE AND ALLOTMENT OF 240,000,000 NEW ORDINARY SHARES (“ISSUE

SHARE(S)”) IN LUMUT NAVAL SHIPYARD SDN BHD (FORMERLY KNOWN AS BOUSTEAD NAVAL

SHIPYARD SDN BHD) (AN ASSOCIATE COMPANY OF BHIC) (“LNS”), AT AN ISSUE PRICE OF

RM1.00 PER SHARE FOR A CASH CONSIDERATION OF RM240,000,000.00, TO THE EXISTING

SHAREHOLDERS OF LNS, BEING OCEAN SUNSHINE BERHAD (“OSB’) AND PERSTIM

INDUSTRIES SDN BHD (AN INDIRECT WHOLLY OWNED SUBSIDIARY OF THE COMPANY)

(“PISB”) (“PROPOSED ISSUE”)

1. INTRODUCTION

The Board of directors of BHIC (“Board”) is pleased to announce that LNS is, at the initiation of

OSB, proposes to undertake an issue and allotment of the Issue Shares to OSB and PISB, at an

issue price of RM1.00 per Issue Share for a cash consideration of RM240,000,000.00

(“Proposed Issue”).

Further details on the Proposed Issue are set out in the ensuing sections.

2. CURRENT SHARE CAPITAL AND SHAREHOLDING OF LNS

As at the date, the total issued and paid-up share capital of LNS as well as the shareholding

details are set out as below:-

Shareholder Ordinary Shares Percentage (%)

OSB 103,000,001 79.23

PISB 27,000,001 20.77

Minister of Finance

(Incorporated)

1 (Special Share) –

Total 130,000,003 100%

LNS does not have any treasury shares and other convertible securities.

3. DETAILS OF THE PROPOSED ISSUE

The Proposed Issue will entail the issuance of 240,000,000 Issue Shares, representing 185% of

the existing total number of issued and paid-up share capital of LNS, to be allotted to OSB and

PISB at an issue price of RM1.00 per share for a cash consideration of RM240,000,000.00 in

accordance with the following proportion: –

Allottee(s) /

Subscriber(s)

Consideration (RM) Proposed Number of Issue

Shares to be issued and

allotted

OSB 190,153,845 190,153,845

PISB – (1) 49, 846,155

Total 190,153,845 240,000,000

Note (1): No consideration will be payable by PISB as the 49,846,155 new Issue Shares will be

transferred to OSB from PISB on issuance.

2

4. RANKING OF THE ISSUE SHARES

The Issue Shares will, upon allotment and issuance, rank pari passu in all respects with the then

existing ordinary shares of LNS.

5. RATIONALE AND JUSTIFICATION

The Proposed Issue is undertaken by LNS with the intention to capitalise the shareholders’

advance by OSB for the purpose of the working capital of LNS.

6. EFFECTS OF THE PROPOSED ISSUE

6.1 Issued share capital

The Proposed Issue will not have any effect on the issued share capital of the Company

as the Proposed Issue does not involve any issue or allotment of new shares in the

Company.

6.2 Net Asset (“NA”) per Share and gearing

The Proposed Issue will not have any effect on the NA per Share and gearing of the

Company as the Proposed Issue does not involve any issue or allotment of new shares

in the Company.

6.3 Substantial shareholders’ shareholdings

The Proposed Issue will not have any effect on the substantial shareholders’

shareholdings of the Company as the Proposed Issue does not involve any issue or

allotment of new shares in the Company.

6.4 Earnings and earnings per share (“EPS”)

The Proposed Issue is not expected to have a material effect on the earnings of the

Company for the financial year ending 31 December 2023.

7. APPROVALS REQUIRED

The Proposed Issue is not conditional upon any other proposals undertaken or to be undertaken

by the Company.

8. INTERESTS OF DIRECTORS, MAJOR SHAREHOLDERS, CHIEF EXECUTIVE AND/OR

PERSONS CONNECTED TO THEM

Save for Tan Sri Dato’ Wira Aziah Ali who is a Director of the Company and LNS, none of the

Directors, major shareholders of the Company, chief executive and/ or persons connected to them

have any interest, either direct or indirect, in the Proposed Issue.

This announcement is dated 26 January 2024

The full nationalisation exercise is implemented as part of sixth supplemental contract signed in LIMA 2023. The exercise had been delayed for four times.

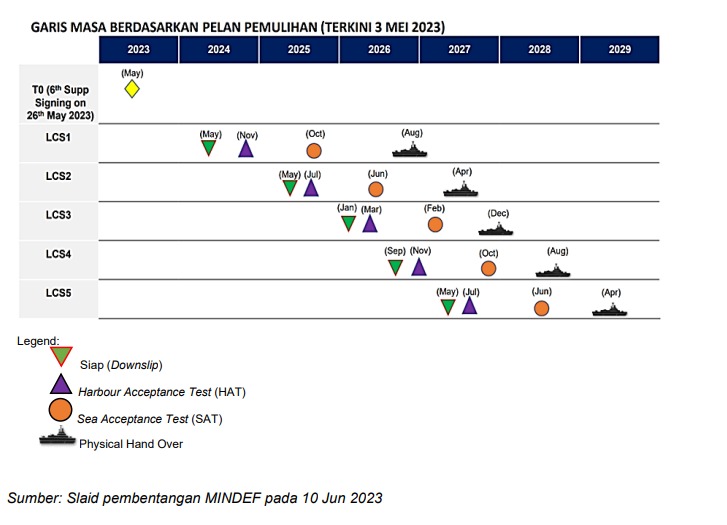

Despite this it is likely that the schedule of LCS delivery will not be adhered too as the Public Accounts Committee (PAC) feared further delays as likely. Under the sixth supplemental contract, LCS 1 – PCU Maharaja Lela – was supposed to be down-slip into the water this May, and harbour trials was supposed to start in November. Delivery is supposed to be in August 2026. If work on the LCS1 is delayed, it will have a domino effect on the other four LCS as well.

— Malaysian Defence

If you like this post, buy me an espresso. Paypal Payment

What then is the diffetence between BNS n LNS?

Both ate under same management. If 9ne had done a bad job, can we expect a better job from the old wine?

Just ganti baju only. The staffs & management still same person lol

Whats your thought Marhalim…should we finish all 5 ship or finish at least 1 or 2 or just scrap and finds another replacement?

We must finish all six or scrap it now.

As for the management

I would propose seconding experienced people from PETRONAS or MMHE to lead the renamed lumut naval shipyard.

No to ex navy or political appointee for now.

As for the gowinds, finishing all 6 is the only option to have lower the final cost per ship, and to give TLDM the ships with the mission capability that it desperately needs (and those should not be LMS B2 corvettes in my opinion)

Personally I would either

1) proposed a merger of LUNAS and MMHE, and this shipyard and this shipyard alone would build naval ship ala St engineering, Fincantieri, DCNS.

2) build up STRIDE as a centralised R&D like is done in Turkey & SK. Stride and stride alone would decide on the foreign JV partners, create the design, then any local companies can bid to manufacture it.

Zaft

Until or unless STRIDE is better funded and we have a clear assessment of what we want to achieve; pointless …

What we need is a single procurement agency comprising MINDEF, the MOF, the services and others; to handle procurement; ensuring we get the needed capability at the right place and ensuring all contractual obligations are met.

The best option for me is to ask Naval Group to dismantle the unit & build from whatever that’s left after dismantling. This is to make sure that the Gowinds are not built with sub-par construction methods. Let them build the first unit & solve any problem thereafter.After that Lunas can just follow the completed unit by Naval Group. Build the rest ourselves.Because you see even if the first gowind will be completed this May, it will not be free from defects & problems. Because it has been a long time since the keel was laid. That being said, there’s harbor trials, & then sea trials for 1-2 year before commissioning. Negotiate a fair price with alternate payment, this is a problematic tender from day one. It is better sooner than later. Time is money.